Best Gold IRA Companies: New Report Helps Retirement Savers Diversify with Physical Precious Metals

IRAinPreciousMetals.com announced its updated rankings of the Best Gold IRA Companies, a guide for Americans looking to safeguard their retirement savings.

NEW YORK, NY, UNITED STATES, October 1, 2025 /EINPresswire.com/ -- With inflation pressures lingering, markets showing signs of volatility, and national debt climbing, many retirement savers are exploring physical precious metals as a hedge—and the updated list of top precious metals dealers from IRAinPreciousMetals offers a vetted resource for getting started.

Gold buyers can find the full list of dealers here.

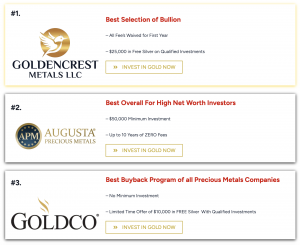

Top 5 Gold IRA Companies for 2025

The following companies earned the top positions in IRAinPreciousMetals.com’s latest review, based on a combination of customer satisfaction, BBB and TrustPilot ratings, account fees, storage options, and promotional incentives:

#1. GoldenCrest Metals – Best Overall - Bullion and Promotions

* All Fees Waived for First Year / Zero Fees Up to 10 Years

* Up to $25,000 in Free Silver on Qualified Purchases

* Low $10,000 IRA Minimum

#2. Augusta Precious Metals – Best for High Net Worth Buyers

* $50,000 Minimum Purchase

* Up to 10 Years of Zero Fees

#3. Goldco – Best Buyback Program

* $25,000 IRA Minimum

* $10,000 in Free Silver on Qualified Accounts

#4. American Hartford Gold – Best Price Match Guarantee

* Ranked #1 Gold Company on the Inc. 5000 List

* Up to $20,000 in Free Silver on Qualified Purchases

#5. Noble Gold Investments – Largest Selection of Bullion

* $2,000 Minimum IRA Purchase

* 5-Star Rated for Customer Service

“These firms represent the best of the best in today’s Gold IRA industry,” said Jeff Brown, editor at IRAinPreciousMetals.com. “They combine compliance, transparent pricing, and proven customer service to help Americans protect their savings in uncertain times.”

Why Gold IRAs Are Becoming Mainstream

Gold IRAs—also known as Precious Metals IRAs—are rapidly gaining traction among retirement savers. Unlike traditional retirement accounts that rely solely on stocks, bonds, and mutual funds, Gold IRAs allow individuals to hold physical gold, silver, platinum, and palladium inside a tax-advantaged account.

Two key structures are available:

* Traditional Gold IRA: Tax-deferred growth, with gains taxed only when distributed.

* Roth Gold IRA: Funded with after-tax dollars, with withdrawals—including profits—completely tax-free if conditions are met.

In addition to the tax benefits, a Gold IRA offers several other advantages that make it appealing to retirement savers. Precious metals provide a natural hedge against inflation, as they have historically maintained their value when the dollar weakens. This protection allows savers to preserve purchasing power even in periods of rising prices.

A Gold IRA also adds meaningful diversification to a retirement portfolio. By holding tangible assets that move differently than equities, Americans can reduce their reliance on the stock market and mitigate overall risk. This balance can be especially important during times of economic uncertainty.

Another advantage is that all trades conducted within a Gold IRA are shielded from capital gains taxes. Unlike selling gold outright, where gains are taxed as collectibles, transactions inside the IRA remain tax-deferred (or tax-free in a Roth structure) until distribution.

Finally, precious metals IRAs can offer estate planning benefits. In many cases, these accounts pass directly to heirs, often avoiding probate and simplifying the transfer of wealth. For families focused on preserving value across generations, this can be a powerful tool.

Visit IRAinPreciousMetals.com for the full list of Gold IRA companies.

Rising Demand Driven by Economic Shifts

Analysts note that the pandemic-era surge in central bank money printing underscored why more Americans look to finite resources like gold and silver. Unlike paper currency, precious metals cannot be created by policy decisions. At the same time, spot gold has historically risen during periods when equities cool, giving retirement savers peace of mind.

“Most people don’t realize that their financial advisor has little incentive to recommend gold IRAs,” Jeff Brown explained. “Brokerage firms earn fees from managing stocks and bonds, but may not profit when customers move assets into physical gold. That’s why independent resources like ours are critical for Americans who want an alternative perspective.”

Custodian and Storage Requirements

Because IRS rules prohibit storing IRA metals at home, Gold IRAs must be held with an approved custodian and depository. IRAinPreciousMetals.com’s updated guide highlights leading facilities such as the Delaware Depository and Texas Depository, which offer advanced security, insurance coverage, and options for segregated or non-segregated storage.

Annual fees vary by provider, but several of the top-ranked companies offer promotional incentives such as waived storage costs or bonus silver for qualifying rollovers.

The Case for Precious Metals in Retirement Portfolios

Financial planners increasingly recommend dedicating 5–15% of retirement assets to nontraditional holdings like gold and silver. Precious metals not only act as a hedge against inflation but also offer portfolio stability during geopolitical shocks, recessions, or market downturns.

“Gold IRAs are not about abandoning stocks and bonds,” Jeff Brown said. “They’re about creating balance. For many Americans nearing retirement, having part of their savings in tangible, IRS-approved metals is a safeguard against risks that are outside their control.”

Free Educational Resources Available

https://IRAinPreciousMetals.com offers a variety of tools for retirement savers, including step-by-step guides on rolling over 401(k) and IRA funds into precious metals and detailed reviews of leading companies.

A Free Gold IRA Buyer Guide that explains account structures, approved coins and bullion, and custodian requirements.

Learn more about their #1 rated precious metals dealer for 2025 here:

https://www.irainpreciousmetals.com/golden-crest-metals-review/

About IRA in Precious Metals

IRAinPreciousMetals.com is a trusted online resource helping Americans explore alternative retirement strategies. The platform provides independent reviews, educational materials, and expert insights to empower individuals to make informed decisions about diversifying with physical precious metals.

IRAinPreciousMetals.com

IRAinPreciousMetals

+1 2124861383

email us here

Visit us on social media:

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.